How PST Works for Items for Sale in BC

This article explains how PST is applied to Items for Sale that are sold on fundraisers in British Columbia.

If your organization is based in British Columbia, you may notice Provincial Sales Tax (PST) being applied to items for sale on Trellis. This is due to provincial tax legislation that requires online marketplace facilitators (like Trellis) to collect and remit PST on behalf of BC-based sellers.

This article explains when PST applies, how it’s calculated, and what you need to do as an organization selling items on Trellis.

⚠️ Disclaimer: Trellis is responsible for the calculation and remittance of PST on behalf of charities, based on direction from an external auditor. We rely on their guidance and the BC Ministry of Finance to calculate applicable BC tax regulations. Trellis is not a tax advisor, and this information does not constitute legal or accounting advice.

When PST Applies

BC law requires Trellis to charge PST on taxable goods and services that are sold in British Columbia.

If your organization’s address (in the Org Profile) is in BC, your fundraiser will be considered based in BC, and PST will apply.

If you are a national organized based in BC but running a fundraiser in a different province, you can update this in your Fundraiser Builder > Fundraiser Settings > General Settings

How PST is Calculated

Trellis automatically calculates PST for you based on the fair market value (FMV) of the taxable portion of an item. This taxable portion may be part of the item’s price (e.g., just the value of merchandise or liquor), or it may be the full sales price, depending on what the item includes.

The system is designed to be flexible, supporting simple items as well as complex packages with both taxable and non-taxable components.

Here are the applicable PST rates:

| Taxable Item Type | PST Rate |

|---|---|

| General taxable goods and services | 7% |

| Liquor | 10% |

| BC Accommodation | 8% |

| Municipal & Regional District Tax (MRDT) | 2% or 3% |

| Additional Major Events MRDT - City of Vancouver | 2.5% |

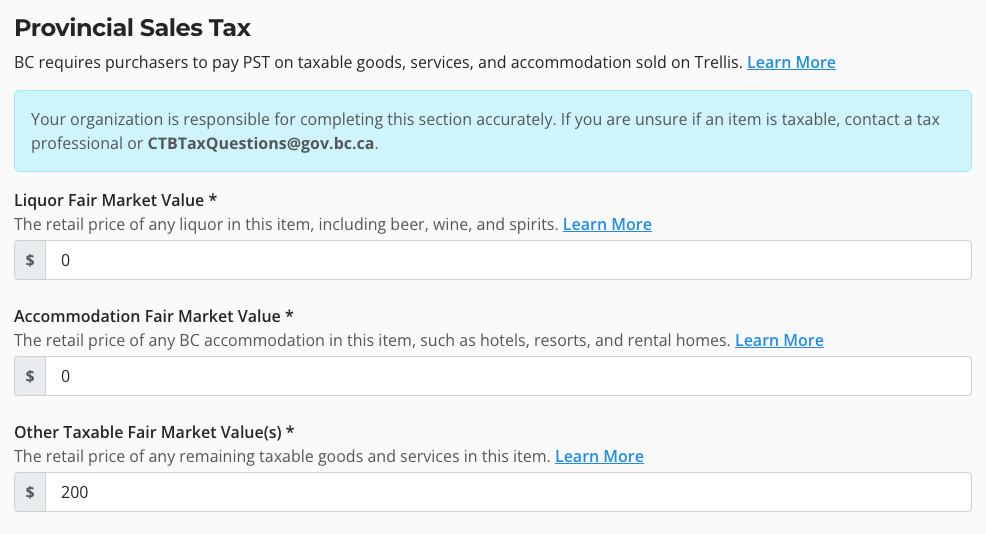

When creating items for sale, you’ll need to provide the following fair market values (FMVs) so we can calculate PST correctly:

-

The FMV of the liquor portion, if applicable

-

The FMV of any BC-based accommodation, if applicable

- The MRDT rate for any BC-based accommodation, if applicable

- The FMV of any other taxable goods or services

PST Reporting and Remittance

Trellis collects and remits PST directly to the BC government for all applicable transactions on your behalf. You do not need to report this PST in your annual filings.

You can view the amount of PST collected in your All Transactions Export, which includes:

-

Sales Breakdown

-

Summary

-

Checkout Overview

Even though Trellis handles PST collection and remittance, the online marketplace seller (i.e. the charity/organization) remains jointly and severally liable for any PST or MRDT not collected and remitted by the online marketplace facilitator (i.e. Trellis) in relation to the online marketplace seller’s sales.

If Trellis is audited and tax is found to be owing due to incorrect inputs, the organization is liable for the tax as well as any interest or penalties.

Frequently Asked Questions

What does "fair market value" mean?

Fair market value is is generally defined as the highest price a good, software, or service would bring in an open and unrestricted market between a willing buyer and a willing seller who are acting independently of each other.

What if we don't know the fair market value or whether an item is taxable?

Whether or not PST applies to an item is not at the discretion of Trellis or the organization. The BC Ministry of Finance determines the taxability of items, and Trellis is required by law to ensure compliance.

If you're unsure if an item is taxable, we recommend consulting your accountant or tax advisor, or the BC Ministry of Finance at CTBTaxQuestions@gov.bc.ca. Trellis cannot provide tax advice.

If we identify non-compliance on your fundraiser:

- You will be invoiced for all outstanding PST.

- A non-compliance fee will be charged.

If there is future non-compliance, your organization will be blocked from using Trellis and no refund will be provided.

What types of items are exempt from PST?

For exempt items, please refer to this webpage from the BC Ministry of Finance, consult your accountant or tax advisor, or contact BC Ministry of Finance at CTBTaxQuestions@gov.bc.ca. Trellis cannot provide tax advice.

What if we've determined the item is not taxable – how do we set that up?

If the item is not taxable, enter $0 for each of the fair market value fields.

Can we choose not to charge PST and have our organization absorb the cost?

No — BC tax law requires PST to be charged to the purchaser and shown separately at checkout.

We have already sold items for sale and did not complete the PST values accurately. What should we do?

You will need to issue refunds for any existing purchases and ask the purchasers to re-buy their items once PST is properly configured.

The organization is responsible for the accuracy of their data. If Trellis is audited and tax is found to be owing due to incorrect inputs, the organization is liable for the tax as well as any interest or penalties.

Where can I see how much PST was collected?

PST data is included in your fundraiser exports, such as the “All Transactions” export. Look for the Sales Breakdown, Summary, and Checkout Overview sheets for a complete view.

Does our organization need to remit PST from auctions ourselves?

No. Trellis collects and remits the PST to the BC Ministry of Finance on your behalf. You do not need to report this amount with your return.

What happens with PST if the item is refunded?

If a buyer is refunded through the Trellis platform, any PST collected will also be refunded automatically. Currently our system does not have the ability to only refund the PST, or to just refund part of the PST.

Does PST apply to offline payments?

Trellis does not calculate or remit PST for offline transactions (e.g., cash or cheque). Please note, you should consult with your accountant or a tax expert on collecting PST for these purchases.

Will buyers see PST listed on their receipt?

Yes. PST is clearly itemized on the buyer’s receipt during checkout, ensuring transparency.

Does PST sync into Raiser's Edge?

No, PST amounts will not sync into Raiser's Edge on the gift.

Need help?

Reach out to our Product Engagement Team at support@trellis.org and we would be happy to assist.