How to Sell In-Person or Cash Canadian Raffle Tickets Through the Sales Entry System (SES)

Organizations in Canada can use the Sales Entry System (SES) to collect in-person payments such as cash or cheque for raffle tickets. Here’s how to set this up and what you need to know.

How to Sell Tickets using the SES

1. Go to the SES

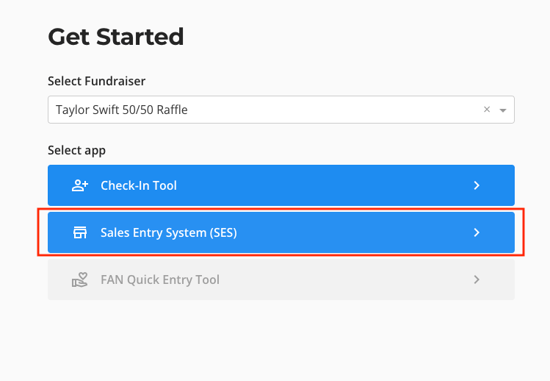

- From your Dashboard, click the person icon to open the Event and Sales Manager.

- From there, select the fundraiser you want to manage, then select Sales Entry System (SES).

2. Enter Sales in SES

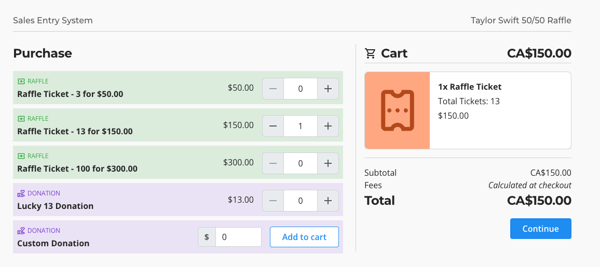

- Select the raffle ticket(s) and quantity you would like to purchase.

- Complete the purchaser's information.

- Note: You can add a company for a purchaser, but a raffle ticket purchase cannot be on behalf of a company, it must be on behalf of an individual.

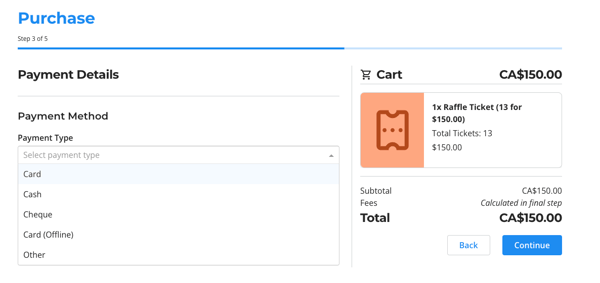

- On the payment method step, enter the payment method. You can select online or offline payment types. Online payments mean that payment is collected through Trellis. Offline means payment is not collected on Trellis.

- Online Payment Methods:

- Card: this opens a form for you to enter credit card details.

- Offline Payment Methods:

- Cash: this allows you to collect cash for the payment.

- Cheque: this allows you to collect cheque for the payment.

- Card (Offline): This allows you to enter a transaction that was paid for using a different processor.

- Other: This allows you to enter a transaction that was paid for using a different method (like a bank transfer).

- Complete the transaction, and raffle tickets will be generated.

3. Collecting and Recording Offline Payments: Cash, Cheque, Card (Offline), Other

- If an offline payment method is selected, you’ll collect and manage the payment directly, as you usually would; no credit card transaction is required in Trellis for cash sales.

- In your All Transactions export, these cash transactions will appear as "offline" sales, with the payment method marked as the method you selected.

- Since no funds are processed by Stripe, these offline sales will not be included in your Stripe payout report.

4. Raffle License Requirements for In-Person Sales

- Make sure your raffle license application includes that you will conduct in-person sales using cash/cheque. This needs to be specified in your licensing paperwork.

5. Reporting Cash Sales to Gaming Authorities

- After each raffle, you’ll need to complete a raffle report for your local gaming authority, as required for all raffles.

- Include all cash sales in this report, ensuring they’re logged as cash transactions in your records.

- It’s essential that your gaming authority is aware that you’ll be conducting cash sales for raffle tickets.

Communication with Gaming Authorities: Check with your local gaming authority if you have questions about reporting requirements or need additional clarification on cash sale processes.

By following these steps, your organization can smoothly process cash sales for Canadian raffle tickets using SES.