Understanding your Checkout Report

In this article, we will explain the parts of the fundraiser report so you can easily reconcile your funds accordingly to what you need

First, you will have to extract your fundraiser report. Please check this article on how to do that - Export Checkout Report

Understanding the different sheets of your report

1. Sales Breakdown Sheet

Contains a breakdown of what purchases are included at each checkout including the fees and if it was refunded .There will be multiple lines for each checkout. Below are important columns you should be aware of:

-

- Purchase Type(column F)

- This line will be the type of purchase, fee, or refund

- Item Name(column G)

- Item Price(column J)

- Gross Paid Amount(column K)

- Payment Processing Fees(column L)

- this is the stripe fee which is ~2.45%(rate depends on the cardholder) + $.30

- Trellis Fee(column M)

- Total Fee(column N)

- Net Total(column O)

- Refund Amount(column P)

- Fee paid by the donor(column S)

- blank if the fee is covered by the org

- Fee paid by the Org(column T)

- blank if the fee is passed on to the donor

- Tax Receiptable Amount(column U)

- Tax Receipt Number(column V)

- Payout Date(column AB)

- Affiliate Link(column AL)

- Purchase Type(column F)

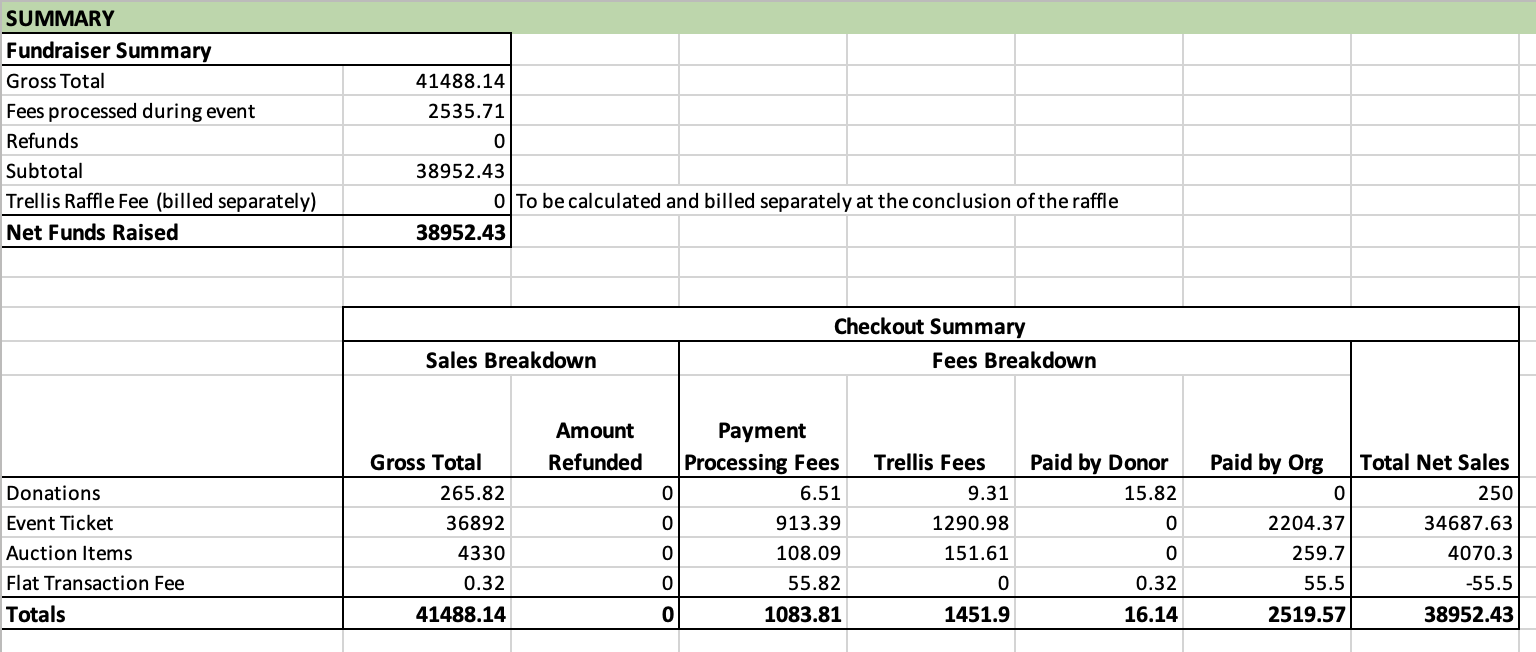

2. Summary Sheet

Your summary sheet will show the following:

-

- Gross Total

- Fees processed during event - total stripe fees charged

- Refunds (currently not logged - check sales breakdown sheet if there are any)

- Subtotal - gross less fees processed during event less refunds

- Trellis Raffle Fee - if you run a raffle you will receive a copy of this report with this fee filled out for you.

- Net Funds Raised

Pro Tip:

The flat transaction fee under checkout summary is separated because this is charged per transaction and not per item on your donor's cart. That means if a donor adds multiple items to their cart(event ticket, donation, and raffle tickets) they will only be charged with one flat fee($.30 cents~)

3. Checkout Overview Sheet

Unlike the Sales Breakdown Sheet, this sheet contains all checkouts in a single line(not broken down what's in each checkout). This sheet is useful for issuing tax receipts outside of the platform and finding the answers for the custom fields you added.

4. Event Ticket Sheet

This contains a plain list of all the ticket holders. *Some tickets may be under the same name if the purchaser used their info to fill out their guest's details.

Pro Tip:

All custom fields that you added will be visible in this sheet.

5. Attendees

This contains all the attendees for your event. *You may see duplicates here again if the purchaser used their info to fill out their guest's details.

6. Donation Sheet

This sheet contains all of the donations and donors' information with their corresponding ticket receipt numbers and fees.

7. Auction Sheet

This sheet contains all of the paid auction items and donors' information with their corresponding winning bid amounts and fees.

8. Item Sheet

This sheet contains all of the items purchased and purchasers' information with their corresponding fees.

9. Raffle Sheet

This sheet contains all of the raffle tickets purchased and the purchasers' information.

Click next to proceed on how to reconcile your deposits with your report

Need Help?

If you have questions or need assistance, reach out to our Product Engagement Team via the blue chat icon or email support@trellis.org.